Zero-Based / Envelope Budget

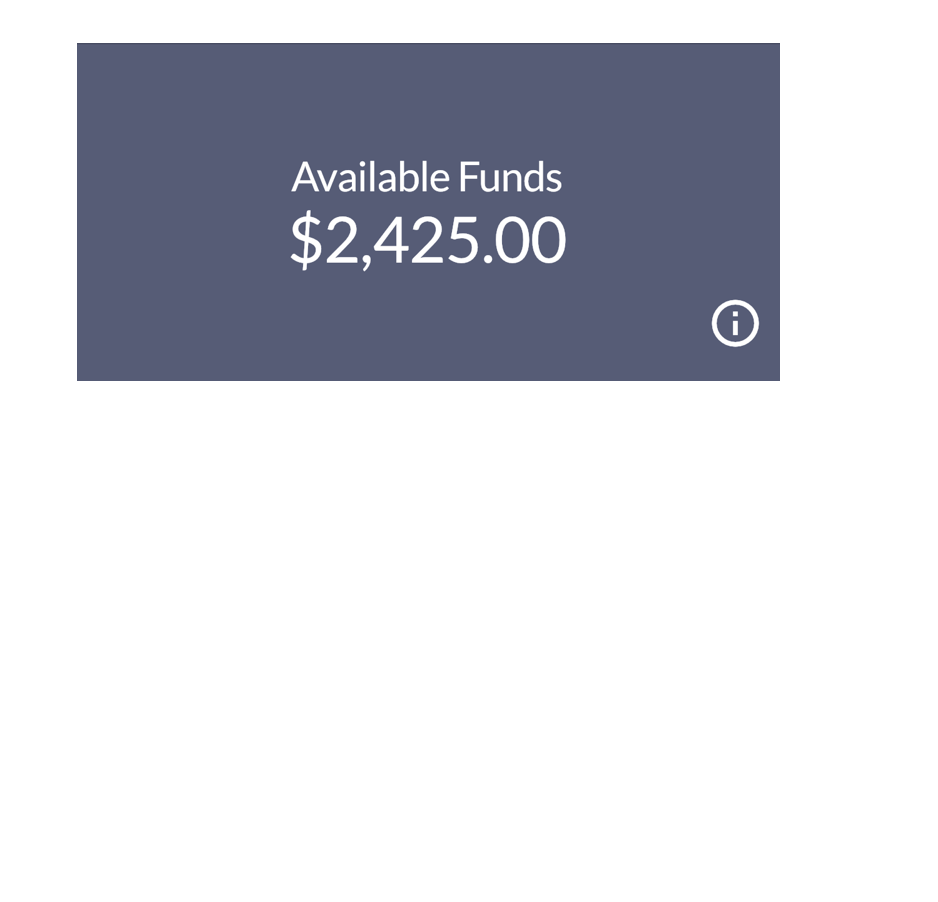

Centsible is built on the concept of envelope budgeting, a form of zero-based budgeting. You tell every cent where it goes before you spend it, giving you greater control and awareness of your finances.

- Rollover unused funds to the next month.

- Easily move money to cover overspending

Bill Tracking

Keeping track of all your monthly bills is tough. Let us help you by entering the due date and amount. Every month you know exactly how much you need to set aside and what you've already funded. Focus on more important things.

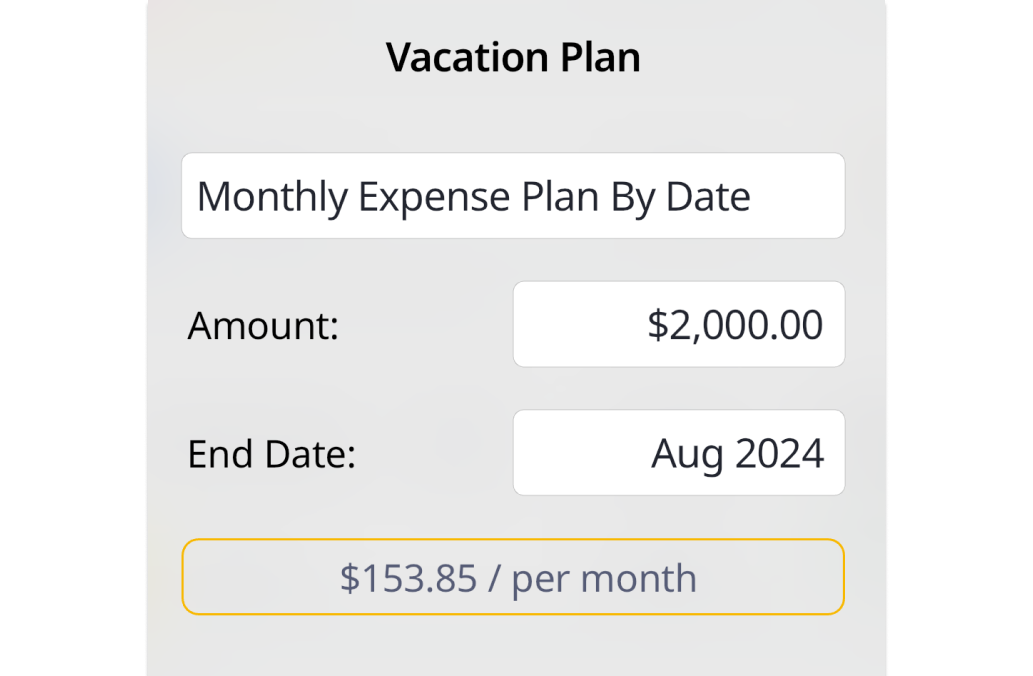

Save For Big Purchases

Don't dip into your savings to make big purchases. Instead create a plan to save for it monthly. Vacation, new fridge, or that renovation? Save for it so you can spend guilt-free.

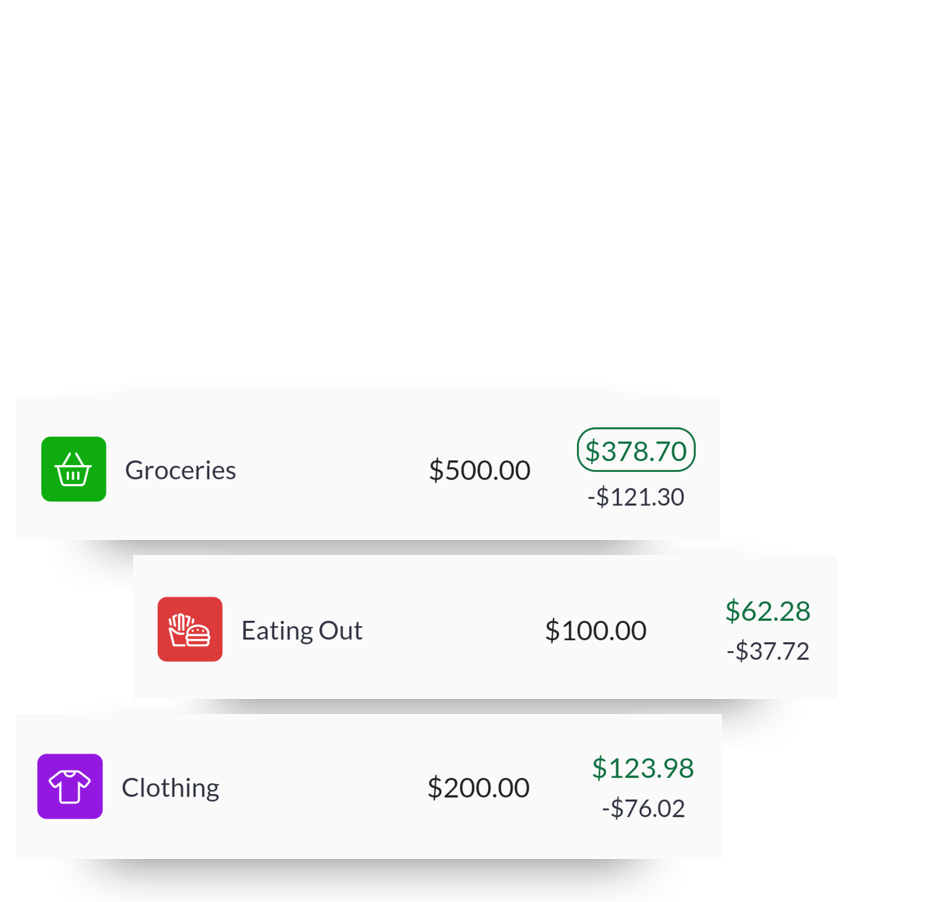

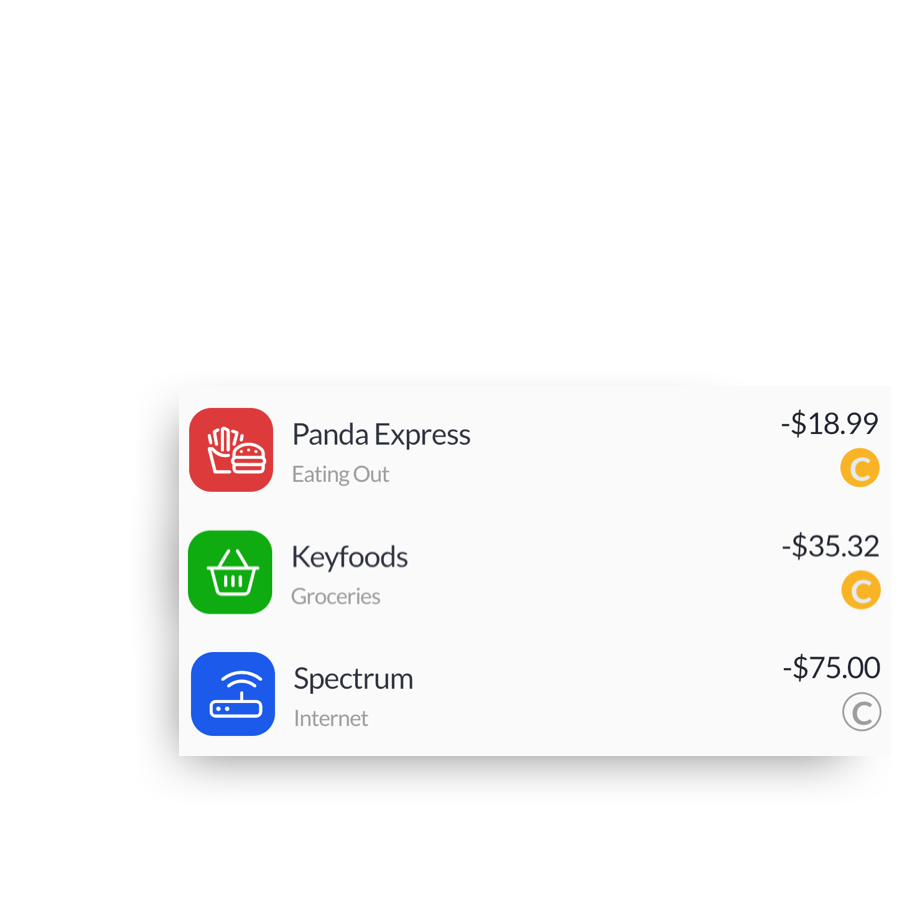

Expense Tracking

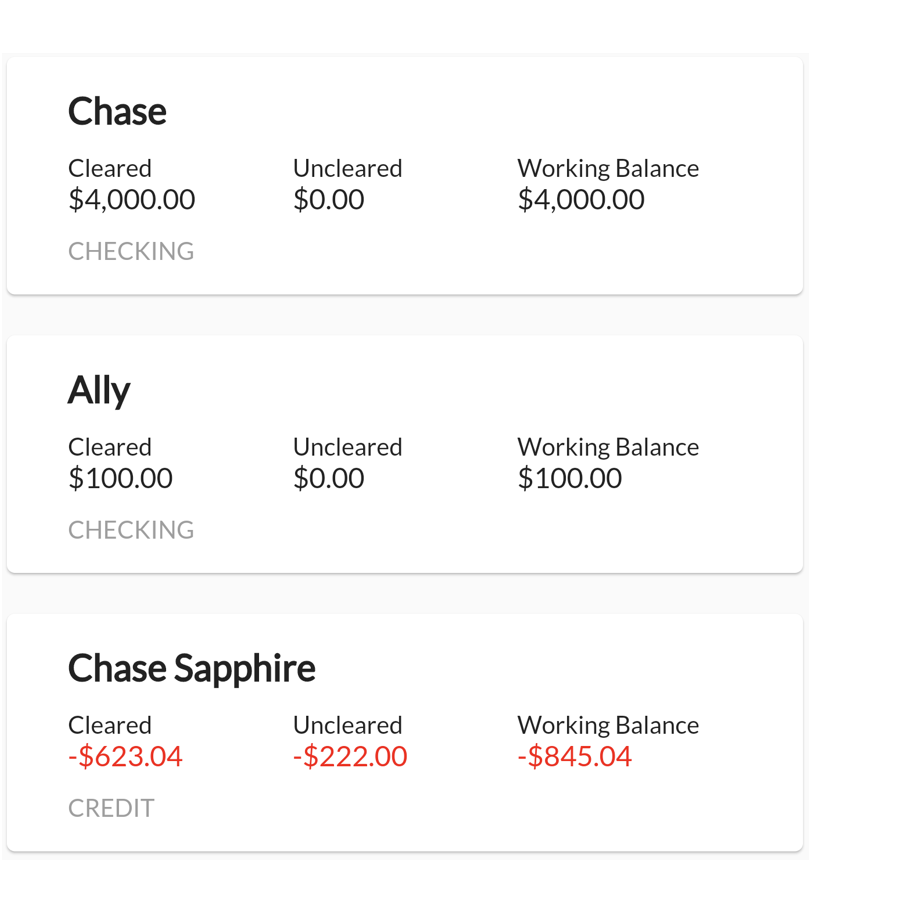

Follow your budget by entering your transactions as they happen. You can split transactions for more control over how your spending breaks down. Reconciliation process so you can ensure your bank balances match what the banks says. Simple recurring transactions to speed up your flow.

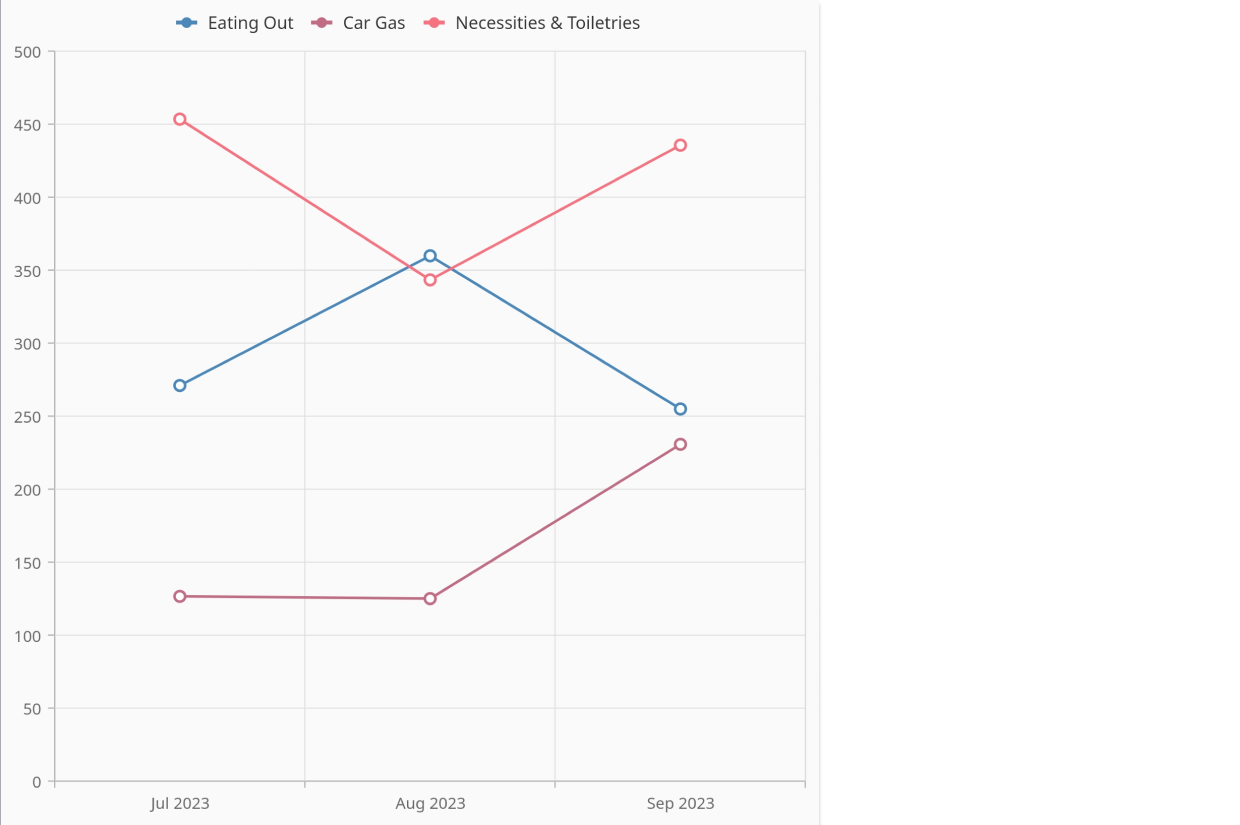

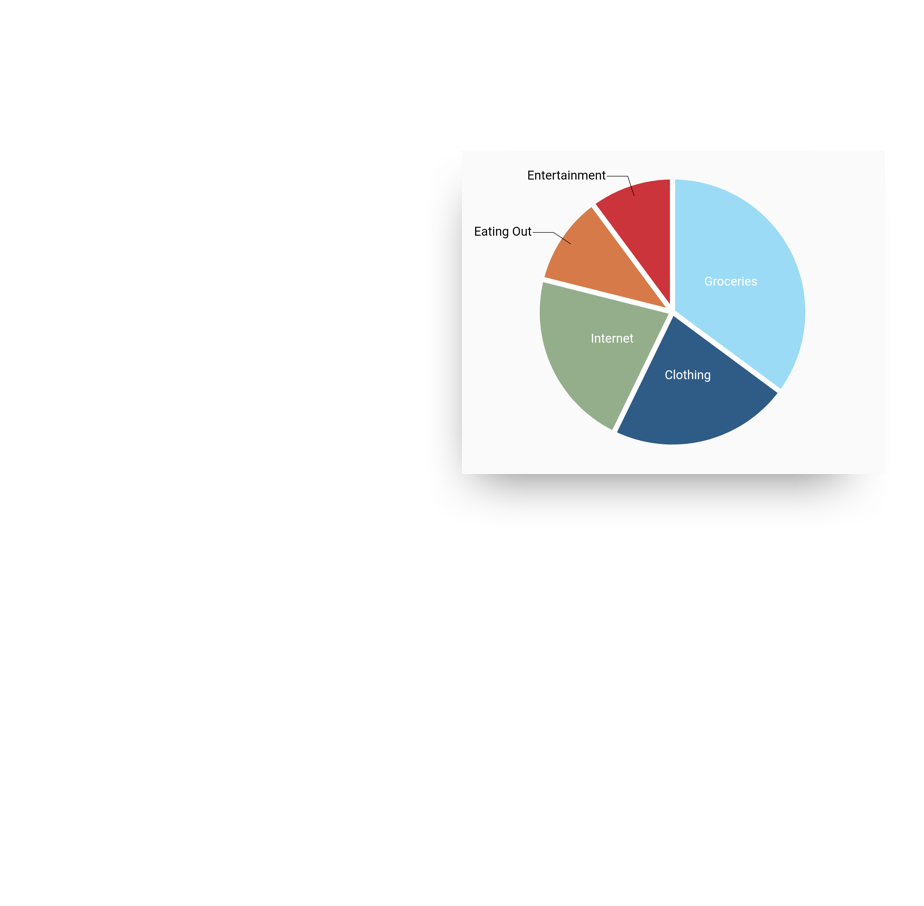

Visualize Your Spending

Sometimes you just want to see how your spending looks like. Want to know how much you are spending vs your income coming in? Want to compare month-to-month spending between categories? Visualize your spending so you can change your behavior.

Simple Pricing

$99.99

Lifetime Offline License

- One-time single purchase for offline access.

- Unlimited budgets, categories, accounts, and transactions.

- Two years of multi-device data sync included.

After two years, an optional $12 per year subscription for multi-device data sync. Dont need sync? No need to pay.

* Prices are in USD. Taxes where applicable.

Any questions?

Check out the FAQs

A lot of work has been put into Centsible. Many of the core envelope budgeting features you find in bigger apps that require a subscription are available here for a one-time payment.

The lifetime subscription comes with two years of complementary multi-device data sync. But the lifetime license is for offline use. Syncing data between devices costs money to store and maintain. It is optional. If you do need it after the complementary two years, we think $1 a month billed at $12 per year is fair.

Centsible does not support direct importing transactions from your bank yet. Cannot rule it out for the future. In the meantime Centsible supports CSV file import.

Centsible supports syncing between devices. This comes included for two years with a lifetime license purchase. Although we currently do not support multiple emails per account, you can share passwords or login for them.

We currently do not support migrating your existing data from another budgeting app. If you would like to switch contact support for the feature request.

Any feedback or feature requests can be sent to support.

We are also trying to build a community in our subreddit, r/centsible. Feel free to hang out there and talk all things finance.

CENTSIBLE

CENTSIBLE