Introducing Envelope Budgeting With Centsible

Several years ago I was looking for a good budgeting app. I had a baby on the way and needed to get my finances in order. I went through the same gauntlet of trying every budgeting app under the sun. One specific method stuck out to me, the envelope budget. It blew me away how much clearer my budget became when I made intentional decisions to put my money into categories and limited my budget to the money I had. No brainer!

The problem? At the time there weren't any modern fully fledged budgeting apps I could exclusively use on my phone. The big player on the block (who has improved this since) is slow to release features and bumped the price up way too high. I spend around 10 hours a day on my computer for work. Probably more if you count other projects. I just don't want to be forced to sit at a desk to plan and get the most out of an expensive app. So I built Centsible.

What is envelope budgeting

For those who don't know, envelope budgeting is where you take all the cash you have on hand, place the money in different envelopes representing how you intend on spending the money, then only spend the money for each envelope where you said you'd spend it.

- Groceries Envelope = $100

- Rent Envelope = $1500

- Internet Envelope = $75

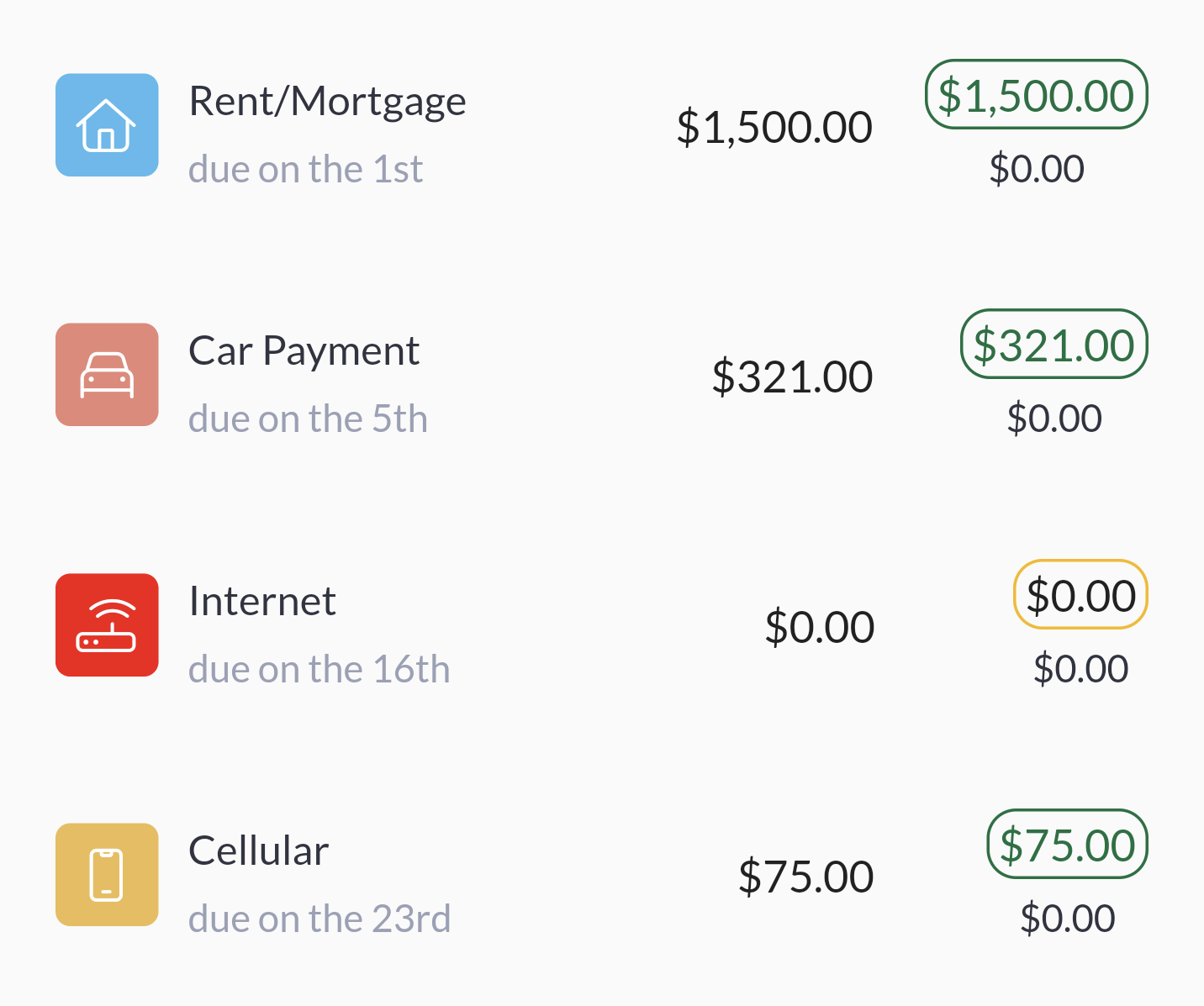

For example, let's say you have a rent or mortgage category. You have to pay the rent. So you label the envelope Rent. Then you put the money for the rent in it so you know exactly what it's for. If you go to the grocery store you don't take the rent envelope. You take the grocery envelope. The good old cash days.

Envelopes worked great in the age of cash. Credit and debit cards have changed the game. Now it's possible to spend money you don't have, hence why envelope budgeting is so powerful. You can simulate the same effect of placing cash you have in envelopes using Centsible. You can place money in any of your categories (a.k.a envelopes).

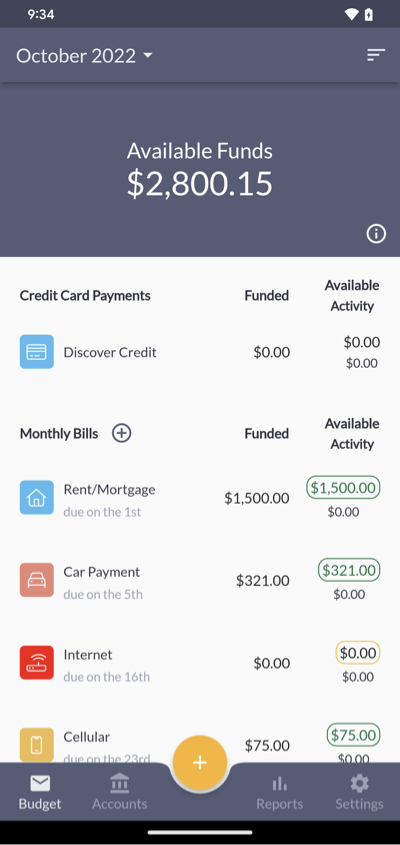

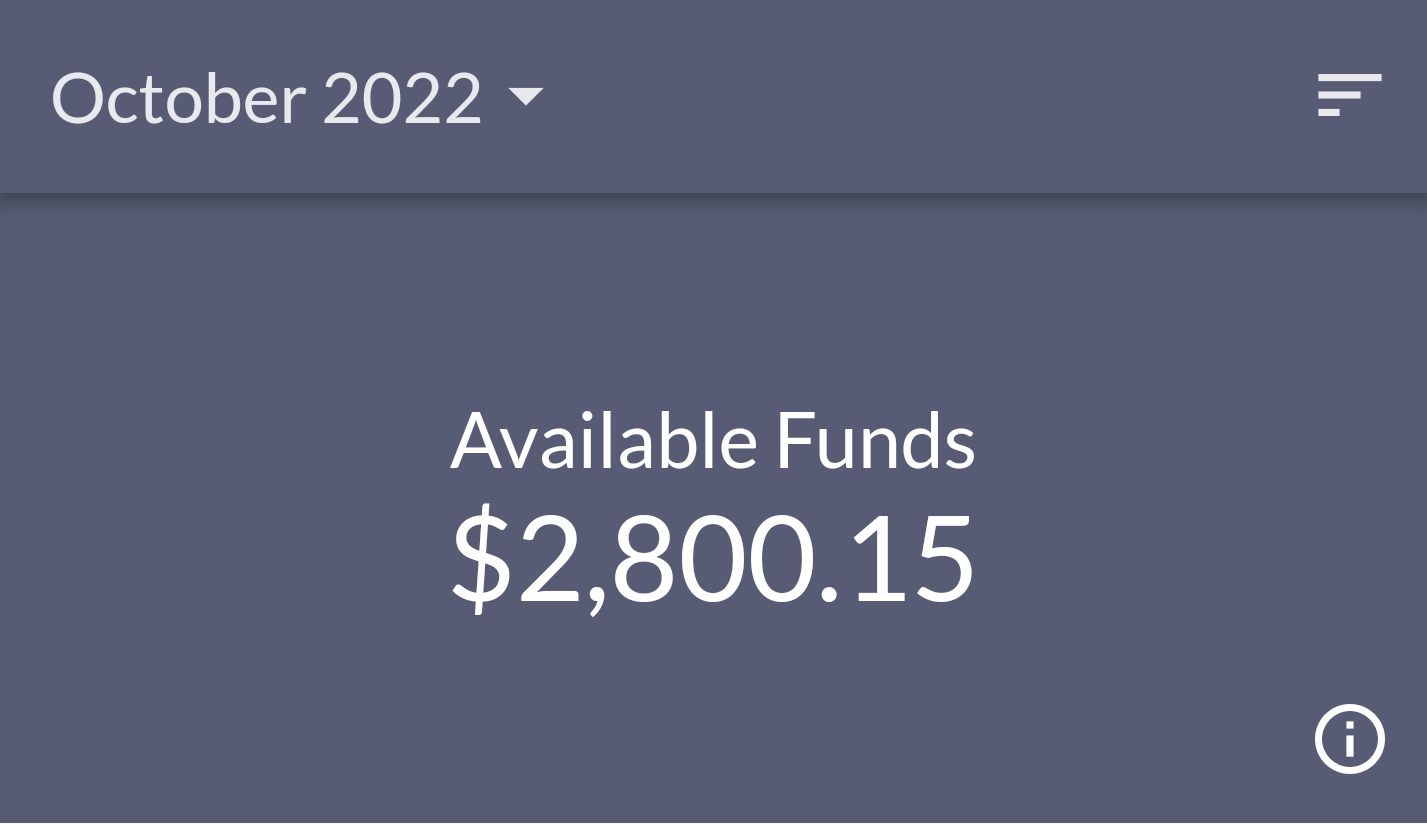

Wait... how do I know when to stop funding my envelope/categories?

Centsible has what is called Available Funds. This value represents all the cash you have available. This money can come from a checking or savings account. Just enter your income and categorize it as Available funds. Once you start funding your categories with available money, your Available Funds will decrease, but your category available amount will increase. You are digitally moving money around. The goal is to budget all of your money so the Available Funds is zero.

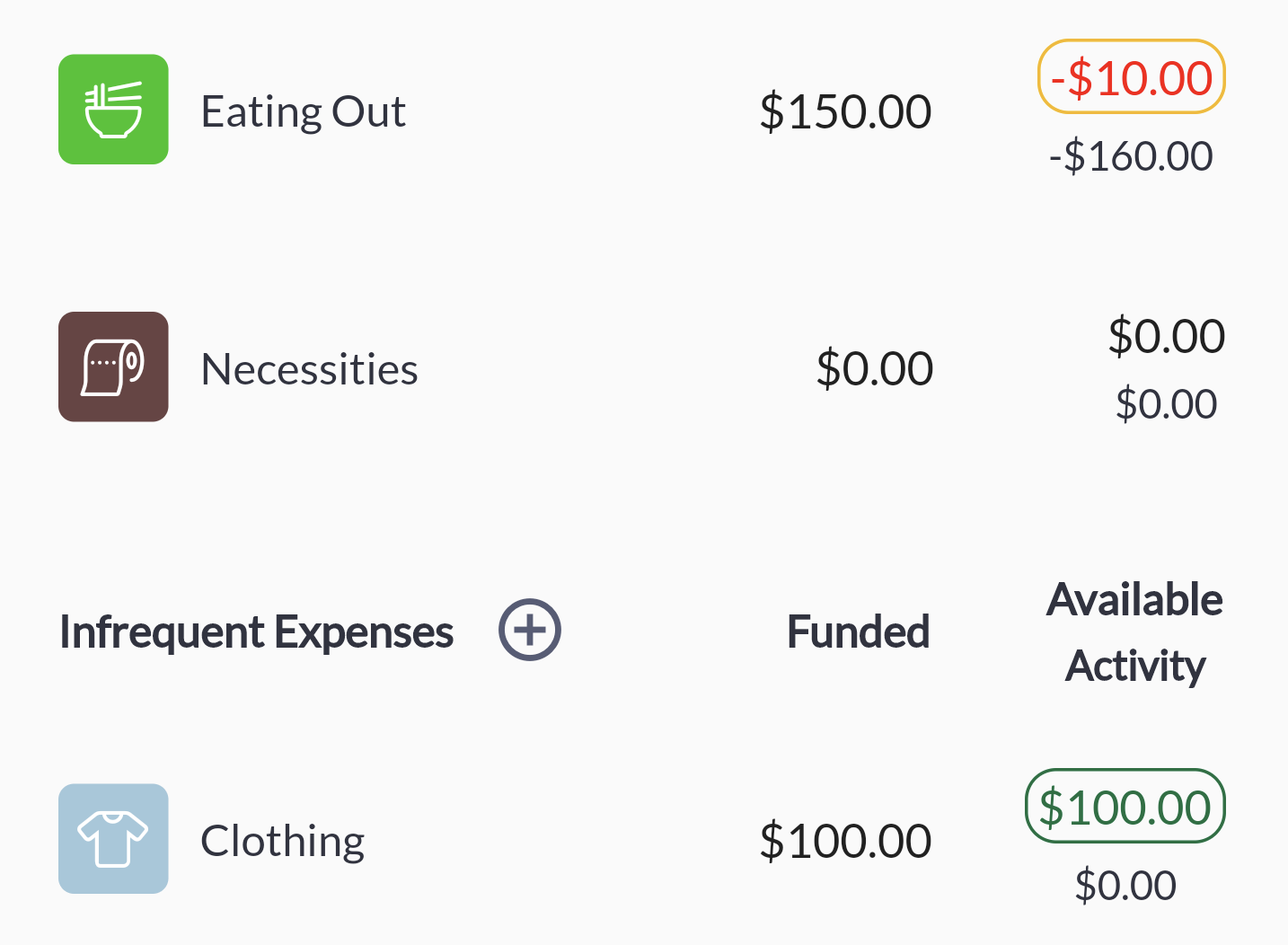

One more visual to illustrate how powerful envelope budgeting is.

Let's say you spent $160 on eating out, but only budgeted $150. We have a math problem. But all is not lost. We can look at our other categories to see where we can take money and move it to cover out eating out overspending. In the above case we can take $10 dollars from clothing just for this month. In other cases the deecision may be harder. But in the end your intentionality changes how you view your money.

Why Centsible

What makes Centsible different? Should you use it?

At the moment I believe we are different for three main reasons:

- Centsible is mobile focused, meaning all features are built with mobile in mind.

- Manual transaction entry only. Which leads to the next one...

- Centsible offers many of the features of the biggest competitor at half the price.

Since I mentioned Centsible being half the price of the biggest competitor, what are the features?

- Real-time sync

- Multi-budget support

- Locale currency support.

- Zero-based/envelope budgeting

- Ability to budget in the future

- Varying plan types to save for monthly bills and sinking funds

- Easily move money between categories

- Due dates on category screen

- Special credit card treatment in your budget

- Simple calculator when funding categories, moving money, and entering split transactions

- Split transactions

- Recurring transaction

- Reconciliation

- Simple transaction filters

- Off-budget account support

- Income/expense report and spending pie chart report.

Roadmap

There is currently no documented roadmap for what's next. I'll get to it. But for those wondering what the future holds:

- General polish of the apps

- OFX or CSV import from banks

- Desktop support for Mac and Windows (mac is done, will be released soon)

- Multi-user support with dedicated email

- Direct import

- Localize the app fully to different languages

- Auto fund the months budget based on due dates and plans

- Potentially add some machine learning (not fully thought this one through)

Free trial

Hopefully this all sounds good. It's free to try. You get a 34 day free trial, no credit card required.

Happy Budgeting!

CENTSIBLE

CENTSIBLE