Cash Envelope Categories For Beginners

I was recently giving advice to someone on keeping track of expenses and budgeting with cash only. Although I built Centsible to bring the cash envelope system digitally, I highly recommend using envelopes to budget cash. But what is the cash envelope system?

What Is The Cash Envelope System?

The cash envelope system is a method of budgeting where you label envelopes with specific spending, also known as categories, then put money into the envelope that represents how much you intend to spend on that particular category. For example:

- Groceries

- Gas

- Eating out

The defining factor of this method of budgeting is that instead of carrying around all your cash, you pre-plan and only carry the envelopes with the specific categories you need to spend. Let's say you are going out to eat with a friend. When you leave you only take the eating out envelope and not any other envelopes, like groceries.

If this sounds like something called "cash stuffing", it's because that's the new popular term for it.

Why Use Cash Envelope Categories?

The cash envelope system is best for people who either deal exclusively with cash or really need to get their spending under control.

A recent study by the MIT Sloan School of Management found that spending on credit cards serves to "step on the gas, driving more spending". In essence it disconnects you from the cost of the item. This is contrary to what spending is like with cash. A previous study by Avni M. Shah showed that spending with cash is painful. The pain, as it turns out, actually made the buyer value the thing they bought more.

So if you have a spending problem, the easiest thing you could do is to go straight to cash. This will bring you two benefits. First, you'll be using psychology to beat your brain. Secondly, it's impossible to overspend when you only have cash. When was the last time a store allowed you to buy something greater than the amount of cash you had on hand?

How To Budget With Cash Envelopes?

Budgeting with the cash envelope system is extremely easy. You need only two things: envelopes and cash. Duh. If your money is in a bank account, just withdraw the cash you intend to budget with. You are now ready to budget.

- Label each of your envelopes with the spending you expect to do. For example, one envelope will be labeled groceries. Another will be labeled eating out.

- Decide how much money you intend to spend on each category until you get paid next. Then you will place that amount in each envelope. Place every single dollar in an envelope.

- Before leaving home to spend money, take only the envelopes you need for spending.

- When shopping only use the money that is available in the corresponding envelope. For example, if dining out look at how much you have in the envelope. If the meal will cost more than what's in the envelope, find a more affordable place, or pick a cheaper item.

Recommended Cash Envelope Categories

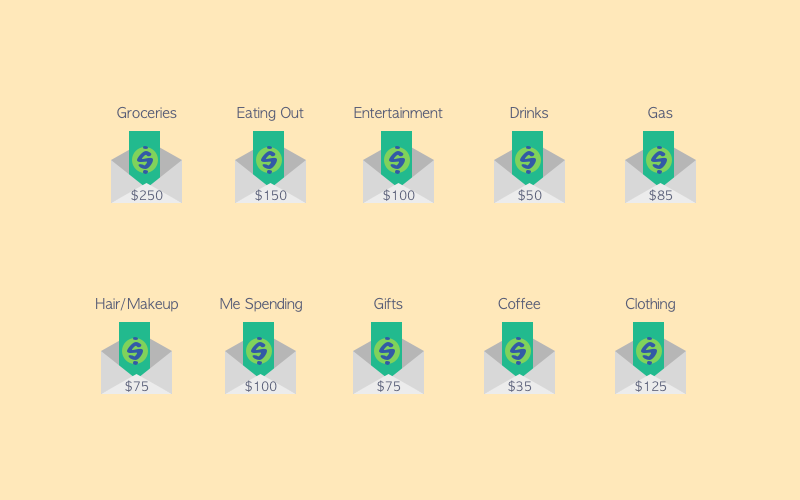

If what you have read sounds right up your alley but are wondering what categories to start with, we got some great starter cash envelope categories for you.

If you are just getting started it is highly recommended you begin with items you tend to overspend. For example, eating out and clothing are big ones. Below is a list to get you started.

- Groceries

- Eating out

- Drinks

- Gas

- Clothing

- Hair/Makeup

- Discretionary spending

- Entertainment

- Gifts

- Pet splurges

- Seasonal celebrations (Christmas, Halloween, etc.)

- Coffee

- Toys

If you noticed from the above list, it does not include monthly spending items like rent, electricity, internet, or car payment. Why?

You could theoretically create envelopes for every spending item you have. A lot of people pay rent in cash. If that's your situation, you can create a cash envelope for rent. But rent is not something you overspend on a monthly basis. If your rent is $1000, until the end of your lease it will still be $1000. Groceries, eating out, clothing, and hair products are all things that can bust a budget. By making the purchases in cash you decrease the chances of overspending.

Do I Use Regular Envelopes?

You might be asking yourself what kinds of envelopes you should use. This is where circumstance and preference comes in. In general it's recommended to just start with regular envelopes you can get at a local office store. They are plain and boring, but they get the job done. Plus they are cheaper than the fancier alternatives.

If you want to have fun with it you can use special envelopes specifically designed for "cash stuffing". They come in difference sizes depending on your needs. They make them small where you need to fold the bills in order to be able to carry it discreetly. Or if you have a purse and don't mind bigger envelopes, you can get them so you can fit the bills whole. They even make purses and books that come with slots for envelope budgeting.

What If I Have Leftover Money?

There is nothing wrong with spending 100% of the money in your envelopes. It's a plan you set. Hopefully your plan was able to include savings so you don't feel guilty spending. But if you happen to have money left over, what do you do with it? There are a few options.

- Roll it over into the next month in the same envelope. For example, you planned to spend $200 on groceries last month. Say you ended up with $50 leftover, now you have $250 for groceries this month.

- Take all the leftover money and put it towards debt pay down.

- You can put the money towards a savings goal. Maybe a vacation or new washer & dryer.

Physical or Digital?

Hopefully you found the example cash envelope categories useful. Lots of people find it exciting to budget with envelopes. But what if you would prefer a digital version?

That is why we created Centsible. You enter your income and can only budget the money in your bank accounts. You can create as many categories as you please and move money between them. Transactions must be entered manually in order to keep you involved with your budget.

Or you can look for another app that works for you. Doesn't matter what you choose, make sure it works for your lifestyle. Good luck and happy budgeting!

CENTSIBLE

CENTSIBLE