How To Budget

Welcome to a complete guide on managing your money with a budget.

We'll cover what budgeting is, budgeting methods, and dispel some common misconceptions about budgeting. It isn't about being restrictive or living on beans and rice.

In reality a budget done right is simply a plan that gives you direction and clarity about your money.

This will change your relationship with money.

Tired of wondering where your money went? Want to take control of your money, pay off debt, and save more money? Then read on.

What is Budgeting

First, let's point out the elephant in the room. Budgeting does not have the most fun reputation.

You can hear the collective groan people let out when someone says "you should budget". What they really hear is, stop buying this. Don't buy that fun thing. Don't spend money. Restriction. Deprivation. It almost sounds like a punishment.

But what if I told you budgeting is not a punishment for your past behavior. It's not actually restrictive. The good news is, you've been budgeting the wrong way.

A budget is just a plan for what you intend to do with your money.

That's it. The definition of a budget really is one short sentence. Just a plan. A plan you have complete control over. That plan can entail spending all of your money if you wish. Or it can include savings.

Types of Budgeting

There are many different budgeting methods you can choose. But when distilled down to their core, there roughly 4 different methods to choose from.

- Traditional budget

- Proportional budget

- Automated budgeting

- Envelope budget

Make no mistake, there are more. But they're usually a spin on these 5 budgeting methods. Out of these 5, only envelope/zero-based budgeting forces you to be proactive and mindful about your money management. Let's go over each one to understand how they work, and why people don't get the results they're hoping for.

Traditional budgeting

Odds are when you picture budgeting, what comes to mind is traditional budgeting. This budgeting method asks you to list out your expenses and how much you expect to spend on them.

- Rent: $1600

- Internet: $75

- Groceries: $200

- Phone: $95

- Gas: $180

In general this form of budgeting is a good start because it makes you aware of your expenses. You will also compare your expense list total to your income and get a general idea of how you are doing financially.

The problem is a list on paper or even a spreadsheet is hard to manage. Every transaction you need to do math and remember to subtract from your expense list. This will get confusing really fast.

For this reason traditional budgeting is usually coupled with expense tracking. This is what apps like Mint do. They help you visualize your expenses by categorizing your transactions. Then you can compare how you say you did vs how you actually did.

The problem is budgeting this way doesn't ask if you have the money yet. What if you get paid twice a month? You only have the first half of your pay. Maybe you went out to dinner with friends unexpectedly. You can look at your bank balance. But the dinner expense hasn't cleared and you have other bills to pay. Are you confident you won't overdraft? Maybe, maybe not?

Your confidence level is low. It's inevitable that you will spend too much somewhere. We are only human. But with traditional budgeting it's difficult to feel confident in your financial position until it's happened. And by then it's too late to make a different decision. Hence this method of budgeting being backwards looking.

Proportional budget

Proportional budgeting is a type of budget where you intend to spend certain portions of your money on specific categories. For example:

- 30% on housing and utilities

- 20% on fun

- 15% on savings

- 15% on food

- 20% debt payments.

The goal is to have 100% of your money accounted for in this proportional budget.

The most popular proportional budget by far is the 50/30/20 budget. This budget method asks you to split your expenses in three categories: 50% on needs, 30% on wants, and 20% on savings.

This method of budgeting can work for some. It does a few things right. Firstly it ensures you think about savings, the 20%. It also caps your needs at 50%, leaving you with discretionary spending. As a guide it works great.

But it has the same pitfalls as traditional budgeting. What if you get paid 2 times a month and don't have the money available for certain spending? Looking at your proportional budget technically says you have the money. But you might not. There is uncertainty, not confidence in your financial situation.

Automated budgeting

Automated budgeting isn't technically a budgeting method. It's more of a feature in how people can budget. The most popular automated budget is Mint. You quickly create a budget and then you just let it handle the tracking for you.

I don't think I need to explain why this is not a good idea. The tech behind Mint is great. The problem is you are not proactively managing your budget. If a machine is doing the heavy lifting, you are not learning any new habits or changing your behavior. I bet you've never heard anyone say how Mint changed their life.

Money really is mostly psychology. Habits need to change. And for that being intentional is a requirement.

Envelope budgeting

Imagine if every dollar you earned was like a tiny employee, ready and eager to work. With envelope budgeting, you are the boss who ensures that every one of your "employees" has a specific job to do and a desk (or envelope) to sit at.

You start by naming different expenses as tasks – things like 'Groceries,' 'Entertainment,' 'Car Maintenance,' or 'Holiday Gifts.' Then, create envelopes for each of these tasks. With every paycheck, it's like a new batch of "employees" has just walked in. As their manager, you decide how many dollars (or workers) you assign to each task, placing the expected amounts in their respective envelopes.

When you need to spend on groceries, you only take from the 'Groceries' envelope. If there aren't enough "employees" in one envelope, you'll either need to reassign them from another task or wait until the next batch arrives with your next paycheck.

Envelope budgeting works because it forces you to think with only the money (or employees) you have now. This reflects reality and makes you consider what is truly important to you. If you don't have enough money in your "eating out" envelope, that's okay. Maybe you can take some money from your "new car" envelope. It just means it will take a little bit longer to save up for that new car. The key is to be intentional and in control.

We love envelope budgeting so much, we built Centsible as a digital envelope budgeting system.

The Centsible Four Step Budgeting Approach

Regardless of the budgeting method you choose, we devised a standard approach whenever creating your budget. Using this approach helps soften the roller coaster that is life. Doing this will increase your chances of feeling like your budget is working, and thus more likely to stick to your budget.

Step One: List your monthly expenses.

This one is a no-brainer. If you've ever budgeted before, this is likely a step you always take. List out every single one of your expenses and write down how much it costs. It is easiest to login to your main banking app and load the last two statements. Then just go through each transaction and figure out if they are monthly. Here are a few examples:

- Rent

- Electricity

- Phone Bill

- Internet

- Insurance (if monthly)

- Groceries

- Trash pickup

- Subscriptions (Netflix, Spotify, etc.)

Step Two: Breakdown non-monthly expenses.

This is what most people get wrong with budgeting. They start with step one, but forget about step two. Without step two, every month will feel like you are going over your budget. Why? Because of non-monthly expenses.

These expenses will typically feel unexpected, usually because they happen every quarter or yearly. So we forget about them.

- Home owners insurance

- Amazon subscription

- Medical expenses

- Car maintenance

- Clothing (for some it may be monthly)

- Vacation

- Christmas or holidays

It's important to think about which non-monthly expenses apply to you and add them into you budget. How you do it is up to you and personal preference. Let's look at two examples on how you would add these types of expenses into your budget.

Car maintenance: say you need $1000 for this every year. You should break down the monthly payment by the number of months until its due. So 1000 / 12. That would be $83.33. A much more manageable number to deal with than $1000 suddenly.

Amazon Prime: at the time of writing this, prime is $139 per year. By using the same formula from car maintenance, 139 / 12, we get 11.58 monthly. More manageable than $139. But if you'd prefer to save $25, $50, or even all of it because it fits your budget, you can also do that.

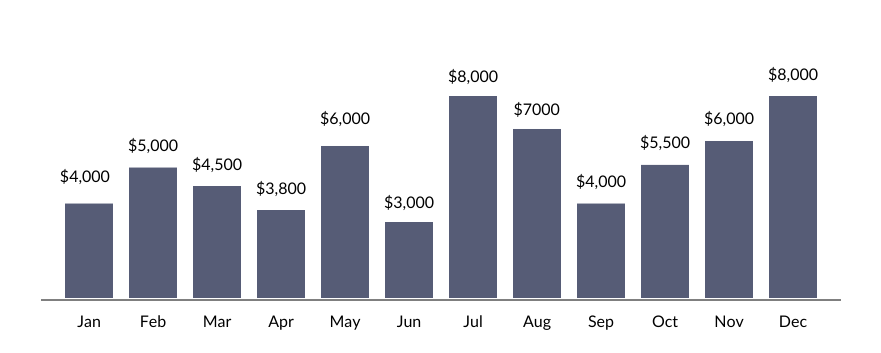

How does this help? Throughout the year you'll have months that are wildly more expensive than others. If you choose to ignore them until they pop up, all the saving you thought you had in the prior months will be taken to pay for the expensive months. In essence, you weren't actually saving with purpose because the money was always going to be spent in those bad months.

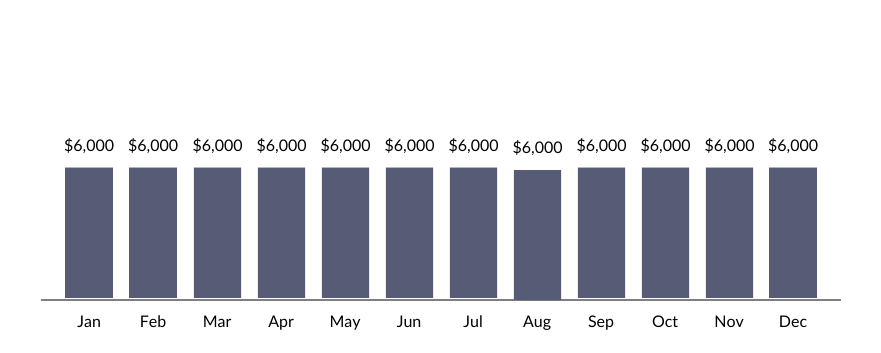

Instead you want to divide and conquer. Rather than dip into your savings to pay for the expensive months, distribute the larger expenses amongst the less expensive months. This will give you a more realistic view of your finances.

Even though both graphs are essentially the same, you can better plan your goals knowing your expenses are more consistent month-over-month.

Step Three: Track Your Plan

The last step is to track your plan. You can use any number of methods to do so. Look into which budgeting method best matches your lifestyle. But at Centsible we recommend envelope budgeting.

Tracking your money in buckets or envelopes makes it super easy to both see where your money is, and also cover overspending. Because let's be real, you will overspend somewhere. We are only human.

Benefits of Budgeting

Guess what? You're probably getting the hang of this budgeting thing by now! You've grabbed the wheel of your money car and are cruising towards any financial speed bumps with ease. And who knows? Sticking with budgeting might just reveal some cool money tricks up your sleeve!

Here 4 benefits of budgeting:

You'll reach your goals.

Pay off debt, save more money, or early retirement. Doesn't matter what your goals are, a budget can help you achieve them.

You'll build wealth.

Think of envelope budgeting as your money's roadmap. With it, you can navigate away from debts, break free from the paycheck-to-paycheck cycle, set up a safety net with an emergency fund, and pave your path to growing wealth. As you master directing your money towards your real priorities, you'll notice your finances flourishing, almost as if it's second nature.

Decrease financial anxiety and stress.

Money is hard. Constantly worrying about whether you can afford something is not fun. Will the credit card be declined? Another overdraft fee? A personal budget can help remove the stress, anxiety, and mental load from all that worry.

Be more confident financially.

Think of budgeting as the cornerstone of your financial life. It can help you make big or small decisions. Love that coffee in the morning? Easy. Eating out with friends? No problem. Can I afford the car? What about my dream home? Can my partner stay home with the kids? Doesn't matter the decision, a budget can bring you clarity so you can make the right decision for your life.

If you want more control over your finances, spend freely without guilt, and build wealth, start a sensible budget today.

What are you waiting for?

CENTSIBLE

CENTSIBLE