Looking For A Kakeibo App?

Finding the right budgeting style and app to go with it can be hard, but we can simplify it by trying the Kakeibo method. But what is Kakeibo?

Kakeibo is a Japanese style of budgeting. What makes this type of budgeting different is that it asks you to manually track your expenses daily while journaling your observations about your spending throughout the month.

What Is The Kakeibo Method?

Kakeibo translates to Household ledger. It was created by Motoko Hani, considered to be Japan's first female journalist. She first introduced Kakeibo in a magazine edition in 1904. The system was geared towards housewives to help them manage their household finances.

When practicing Kakeibo you must ask yourself four questions:

- How much income do I have?

- How much do I want to save?

- How much am I spending?

- How can I improve?

Although some of these questions follow a similar path as budgeting in the west, Kakeibo flips that on it's head by asking you to be mindful of your finances by writing it all down in a journal.

In this journal you both track your finances and write down your thoughts and observations throughout the month. Doing this makes you intentional with how you spend your money.

How To Use Kakeibo?

Kakeibo has a simple method to get you started. It focuses on four main categories:

- Needs

- Wants

- Culture

- Unexpected

Needs

Needs is pretty self explanatory. They are things we cannot live without, like food, rent, toilet paper, shampoo, etc. It's very important you are honest with yourself here. Just because you feel like you can't live without ordering from Amazon or Target does not make it a need.

Wants

Another self explanatory category are wants. This is where you can add your Amazon or Target addiction. Maybe you like fashion, or just going out to dinner with friends. Those can go here.

Culture

What is life without culture. This can be thought of similarly to entertainment. Movies, video games, concerts, etc. But it can also be museums or books.

Unexpected

Life sometimes throws us curveballs? We should probably plan for emergencies here. Car repairs, medical bills, etc.

What Is Centsible?

Centsible is a budgeting app that's built on the principles of envelope budgeting. In envelope budgeting you:

- Get envelopes and label them after your spending (ex: groceries, rent)

- Take all your cash and divvy up the money between all the envelopes.

- When it comes time to spend, you take only the envelope you need. For example, if you were going to the grocery store you wouldn't take the electricity bill envelope.

Envelope budgeting was popularized in a time before credit or debit cards. So if you were wondering why anyone would do that in the credit/debit age, that's why. In the old days you could not spend money you did not have. So it was important to spend mindfully. Otherwise you might not have money for food.

Today you can overdraft or use credit. But that's not good. Digital envelope budgeting mimics the mindfulness of the traditional envelope system, but with credit/debit cards.

How to Use Kakeibo In Centsible?

If you like the idea of Kakeibo but want to pair it with an app vs pen & paper, Centsible might be exactly what you need.

Kakeibo and Centsible are very similar in a few ways:

- They both utilize categories in order to track expenses.

- Both require you to look at your current income.

- You also need to manually track your expenses for both.

That being said, Centsible is different in one main area. You do not have to journal your process since all your finances are available on your phone. This doesn't mean you should not carefully consider every spening decision. You will get the most out of Centsible if you do. Let's take a look how this looks.

Enter you income

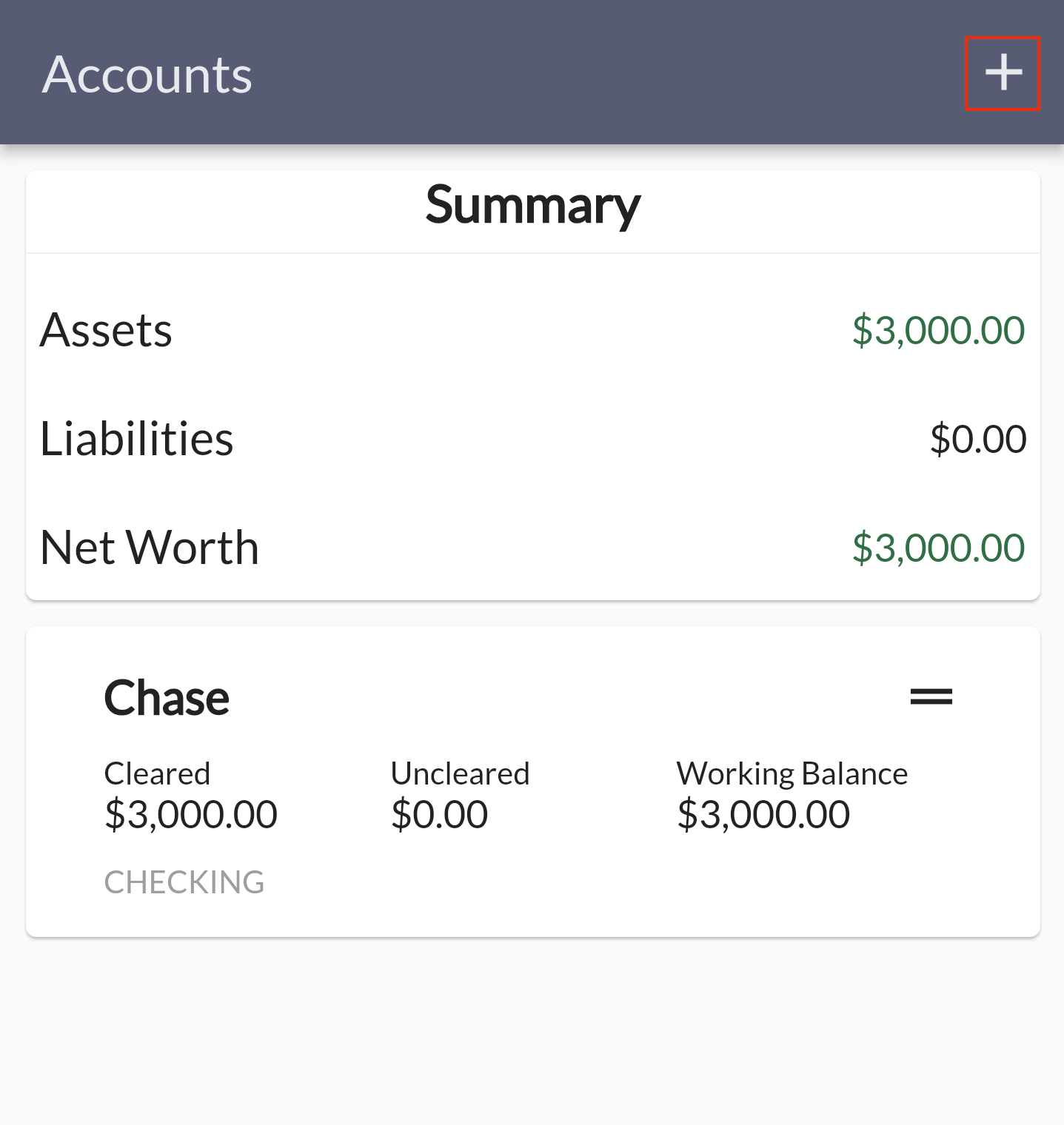

In Centsible you can start by adding your checking and savings accounts. The app will tally up all your income so you can answer the "how much income do I have" question. You do that by navigating to the accounts tab and selecting the plus icon.

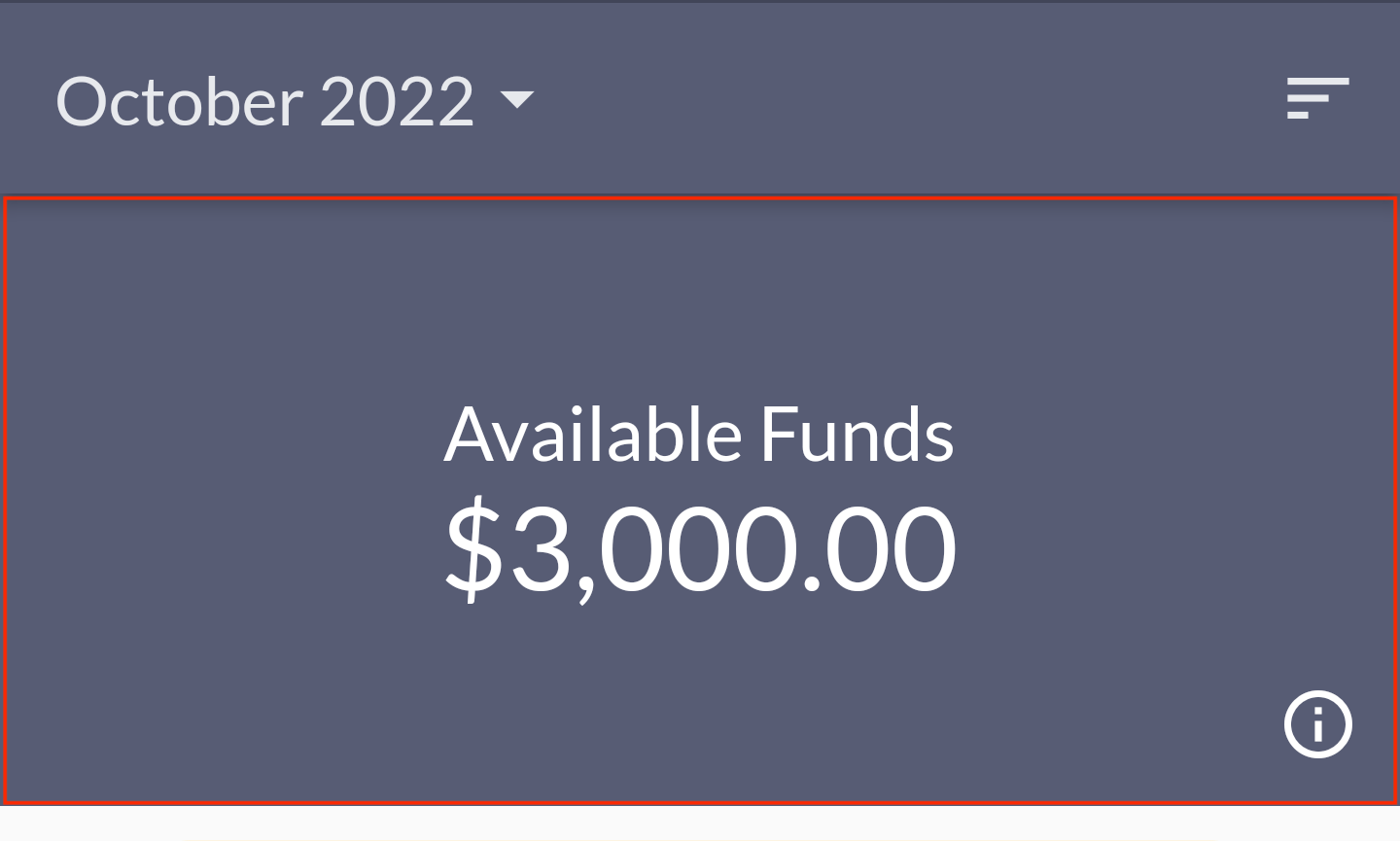

Then once you add all of them, navigating back to the budget tab at the top you will see your total available income to budget with.

Enter your categories

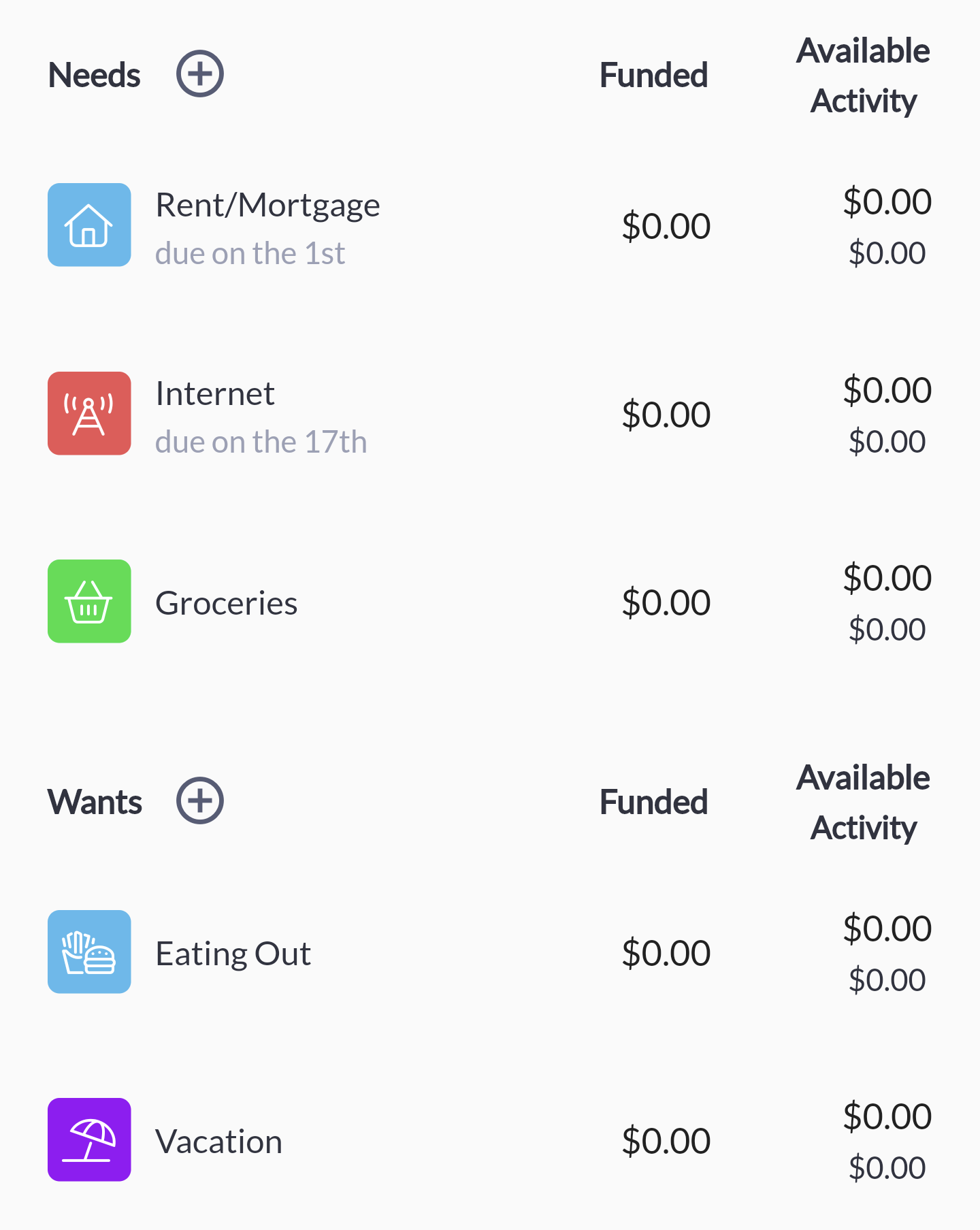

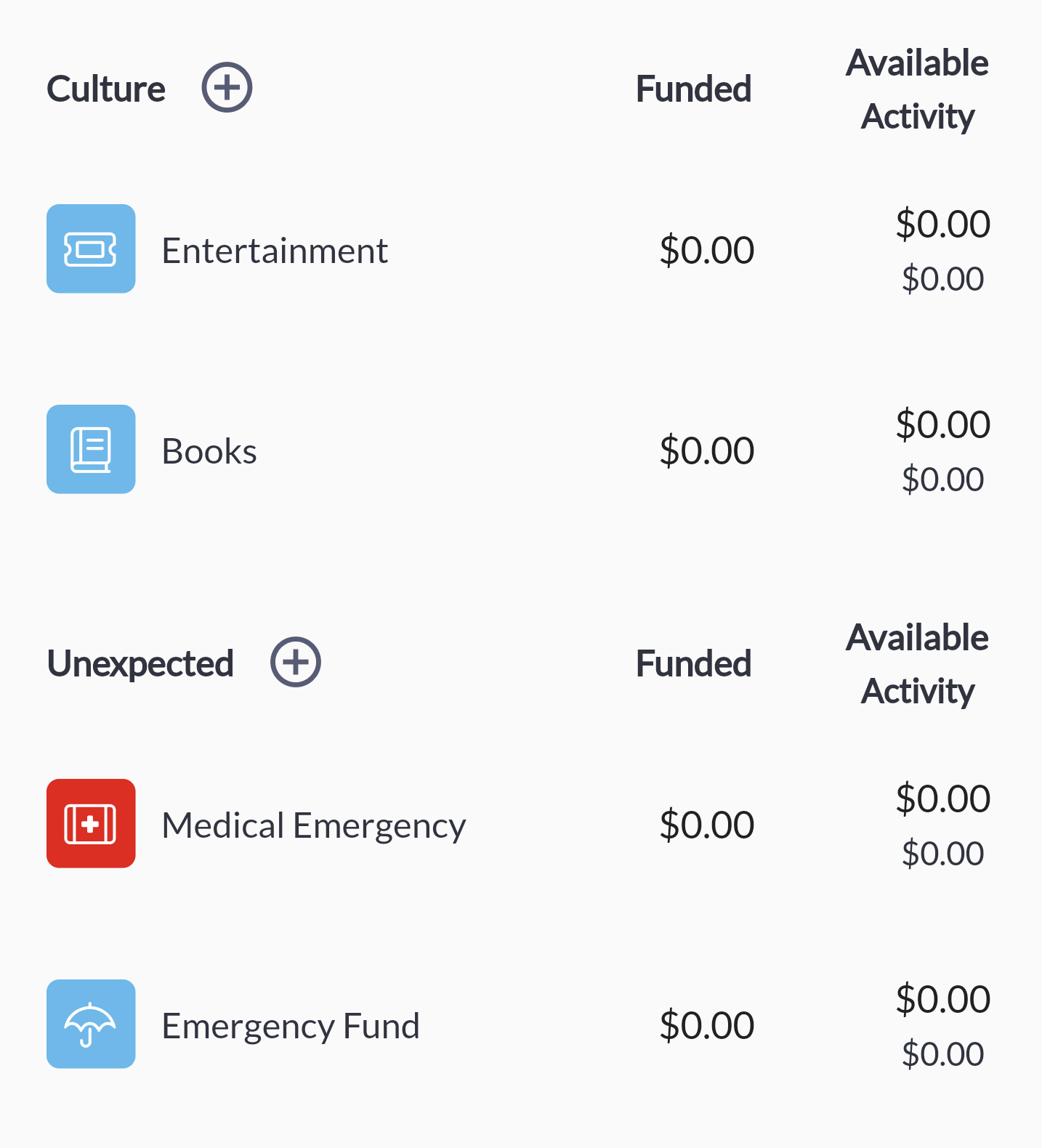

When creating a budget in Centsible you get some default groups and categories to logically separate everything. But you can rename the existing ones to match the Kakeibo categories.

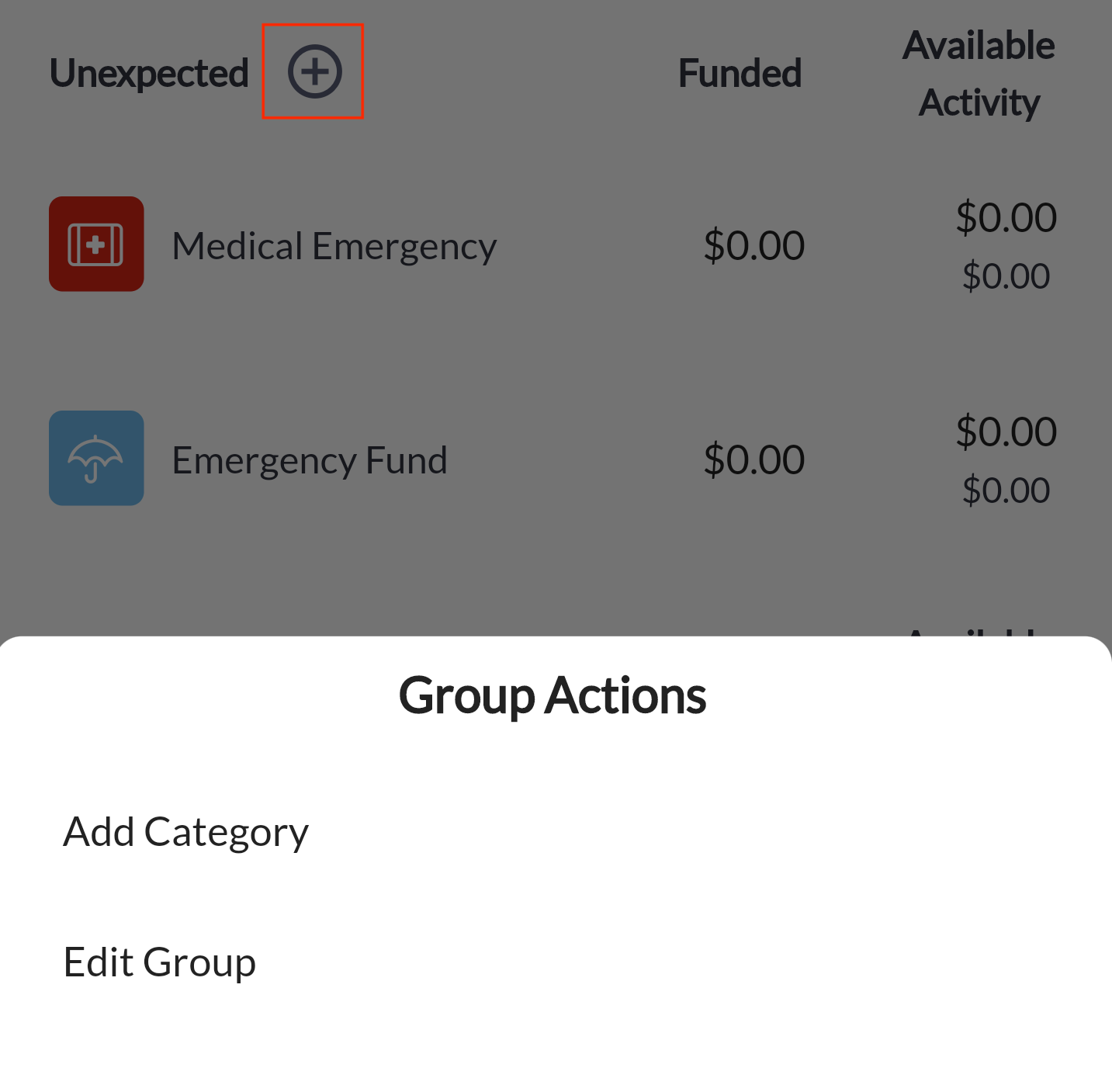

You can add more categories under each group by clicking the plus icon and selecting whether you want to add a new category or edit the group name.

Fund all your categories

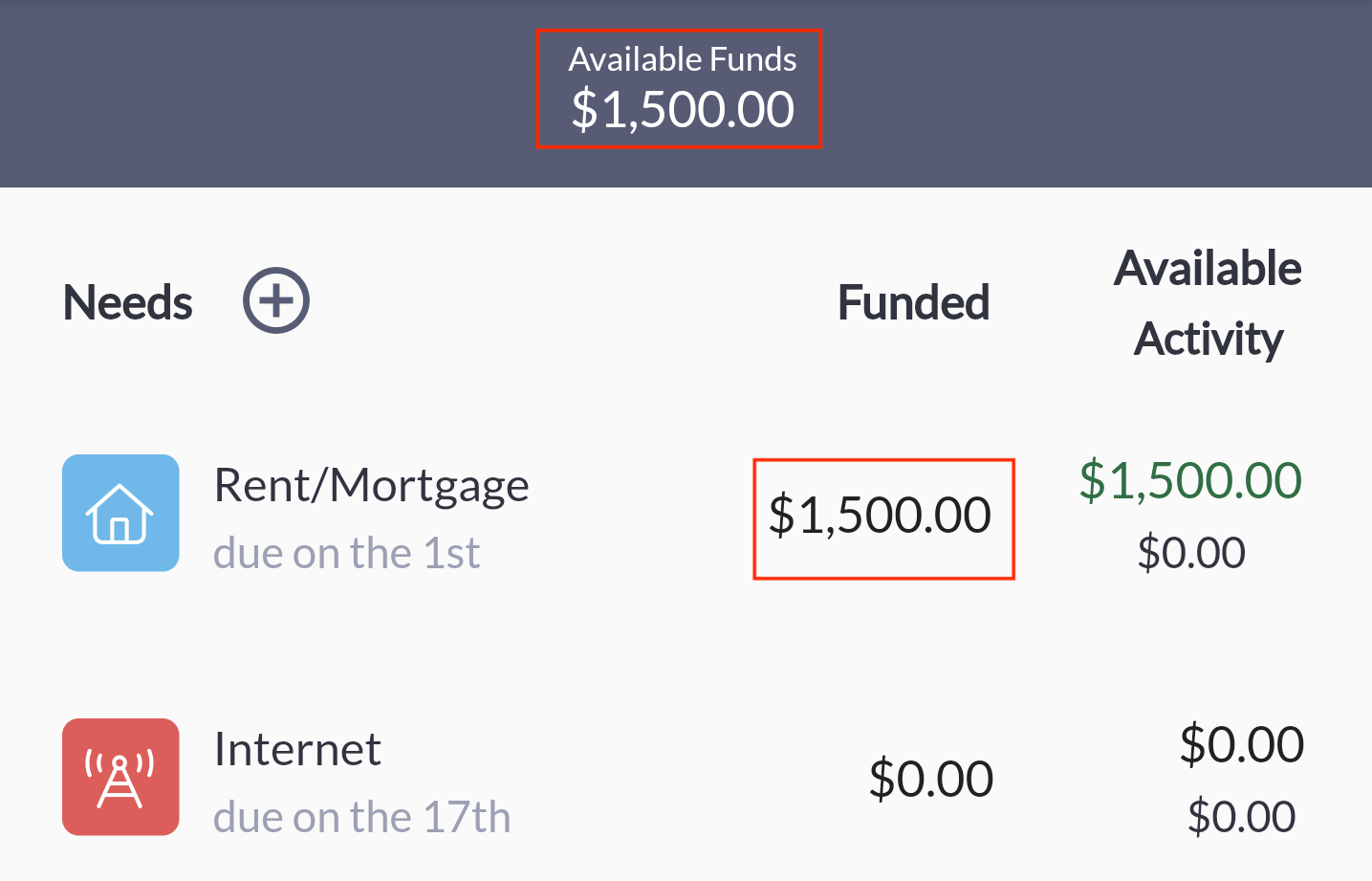

The cool part about budgeting with Centsible is funding your categories. This step is the part where you ask yourself how much you want to spend with the "Available Funds" you have. Just like Kakeibo, Centsible helps you be more intentional about how you intend to spend your money.

If you remember when first adding your income, the "Available Funds" was $3,000. But now it's $1,500. This is because you said you want to spend $1,500 on your rent. You now must fund the rest of your categories with the remaining $1,500. If you have a savings goal this is where you can create a category and fund it. Remember, in Kakeibo the goal is to help you save money.

Track Spending

Kakeibo expects you to track your expenses daily and be mindful of your spending.

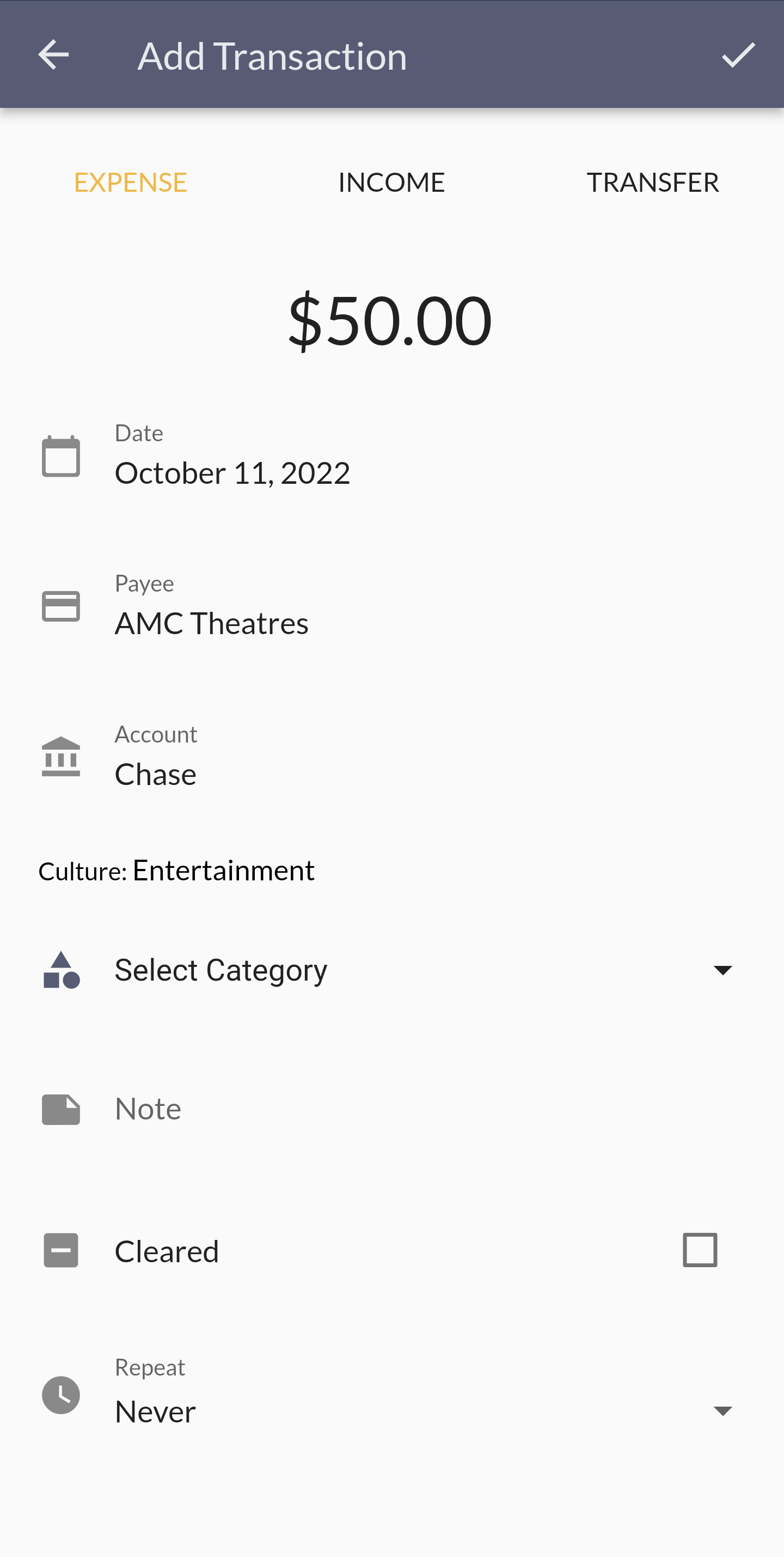

You can easily track expenses with Centsible. Simply click the plus icon by the bottom tabs and you'll be able to enter transacations manually. We believe manually entering transactions is necessary in order to keep you aware of your budget. By using an app you can even enter your transactions at the moment you make them. I'm sure the cashier won't mind.

Evaluate the end of the month

The last point to look at is the final Kakeibo step. How can you improve. Centsible offers several ways of being able to track your budget.

Once a month is over, you can easily visit the previous month to conduct a post mortem on how you did. Does how the month ended match your plan? Were your savings categories affected? Or were you able to save exactly as you planned?

Additionally Centsible has some simple built-in reports to visualize your spending.

Centsible and Kakeibo

We believe the Kakeibo method goes well with Centsible. It is free to try. Check it out at centsible.app. But if you feel like you'd prefer pen & paper, we think that's a great choice as well. Happy budgeting!

CENTSIBLE

CENTSIBLE