What is a Sinking Fund? The Money Secret They Never Taught You in School!

Picture this - you've been so tired of feeling stressed about money. So you decided to take your finances serious. You created a solid budget. Rather than take that coffee run, you squirreled away that money to pad your savings. Your emergency fund was beginning to grow. You thought, "maybe I can do this".

And then BAM, your car won't start. Or you dropped that brand new phone in just the right angle but didn't get insurance. Phones aren't cheap these days. You keep having to dig into that emergency fund you've been working so hard to build. So you think, "budgets don't work!".

Not so fast. I have some good news. It's not the budget. There is a way to combat these expenses that feel like they come out of nowhere. It's called a sinking fund. This little-known strategy is how you combat these sneaky, yet expected expenses.

What is a Sinking Fund?

So you're probably asking yourself, what the heck is a sinking fund? A sinking fund is a saving strategy where you set aside money little by little over time in a specific pot. That pot of money is earmarked to a specific larger expense. Think of it like a savings account you have for that one thing.

You may have already been doing this without really thinking about it. Hopefully rather than put that vacation on credit, you have actually been setting aside money over time. Likely in a high yield savings account. Well, this is essentially a sinking fund. You were doing that to be prepared for the eventual wave of expenses you would incur while on your trip.

Take Jenny, for instance. She set up a sinking fund for her car maintenance and another for holidays. Jenny will now be prepared for these expenses attempting to ambush her budget. Rather than be unexpected, they are now part of her budget just like any other expense. This has been a game changer. Her stress levels are much lower knowing she's accounted for expenses most people think are a surprise. She's never been this in control over her money before!

The Difference between a Sinking Fund and an Emergency Fund

But wait. You're probably asking, "Isn't a sinking fund just an emergency fund?". It's understandable why you would think that. They're both a form of savings, right? But they both serve a distinct purpose in your financial plan.

Think of an emergency plan as a safety net. It's meant to catch you in the event life decideds to throw you a nasty surprise. These unexpected events could be a job loss, sudden illness, or a tree falling on the side of your house. These are things you can't see coming.

Sinking funds, on the other hand, are funds for things you know are coming, or rather are expected expenses. You know your car or house will need maintenance. Christmas and Thanksgiving come every year. How can the flight to moms house be that unexpected when it happens every year? But if you don't plan for it, they can feel like emergencies.

Let's go back to Jenny's example. When her car's transmission broke down, she was not panicking when her car maintenance fund was depleted. Instead it was an unfortunate inconvenience. One that she was prepared for because she had the foresight to have a sinking fund.

Taking into account the differences between a sinking fund and an emergency fund, you should be ready for both the expected and unexpected events. You'll be financially prepared for anything.

How to Set Up a Sinking Fund

Are you ready to make that stress melt away? Great! Setting up a sinking fund is straightforward, and I'll walk you through the process. There is a three-step process: Identify, Calculate, Start Saving.

Identify

First identify what you need a sinking fund for. Own a home? Probably a good idea to have a maintenance fund. You already know the car maintenance fund. A fun one is a Christmas or holiday fund. It happens every year. A vacation fund is also a great idea.

Calculate

Once you've identified what you are saving for, it's time to figure out the numbers. It's surprisingly easy to get this set up. Let me illustrate with a popular example.

Phones today are very expensive. Many folks do the payment plans. But you can save up for it ahead of time. Phones run about $1000. Since the cycle is about every 2 years, 1000/24=41.6. You simply divide the amount by the number of months until you need the money. That's about $41 bucks per month. Much more manageable than most people think.

Start Saving

This is the fun part. You have several ways to make your savings clear. You can stash away the cash in a piggy bank. Or maybe having separate savings accounts works for you. You can auto transfer the amounts necessary so you don't need to think about it.

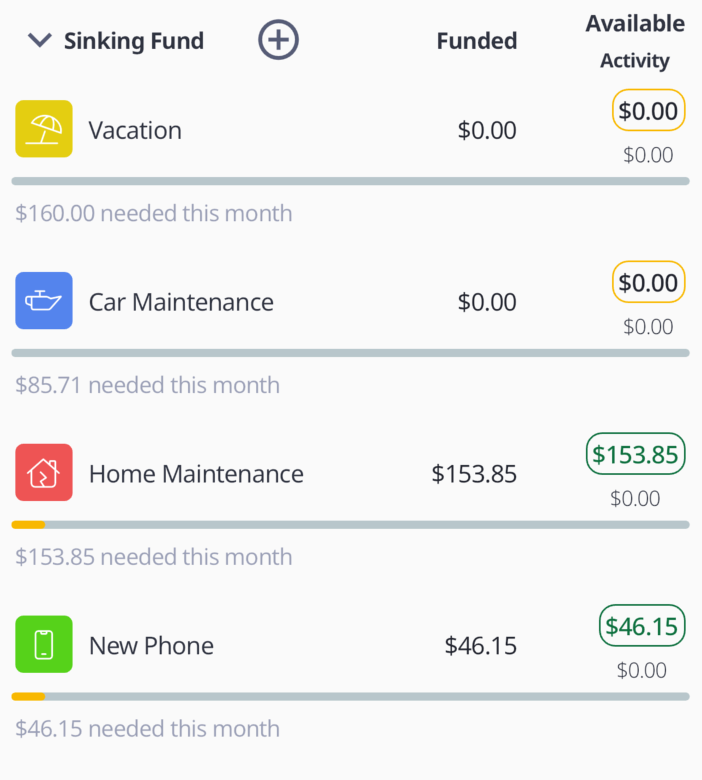

We are of course partial to budgeting apps, like Centsible. You add a new category that represents your sinking fund. Set a plan by date. Centsible does the math for you and reminds you to set aside that amount every month.

Real-World Applications of Sinking Funds

Now you're probably wondering how to best use sinking funds in your budget. Good news is they are flexible and you can fit them however you see fit into your financial plan. Let's dig into some common uses.

Annual/Quarterly Bills

As mentioned by Jenny's example, a popular use of sinking funds is non-monthly bills. I can't count the times I would get seemingly random yearly or quarterly expenses I should have seen coming.

- Home insurance

- Car insurance

- Annual subscriptions (amazon prime, email service, costco membership, etc.)

A quick note about subscriptions. Everyone is different and has different needs. Some subscriptions can be $80 a year, and you may want to just immediately set aside the money for it. Or you can set aside the $6.60 a month to slowly build it up. It's up to you.

Savings Goals

Savings goals are the perfect expenses to use sinking funds with. Some of these are:

- New phone

- New computer

- New car

- Christmas / Holidays

- Vacation

- Home down payment

- Emergency fund

Let's take a vacation for example. Say your dream vacation costs $3000. Maybe you want to do it in a year, so 12 months. The math is 3000/12=250. Maybe 250 isn't bad. Or maybe you push the vacation another year so you can save for other wants. So it'll come out to $125 per month for 2 years.

Christmas or holidays are another big item most people don't consider, but should. Every year Christmas rolls in, and every year we spend too much. Maybe it's time to set aside the money throughout the year to prepare for Christmas, or flights to visit grandma for Thanksgiving.

Lastly, you could save for your emergency fund using a sinking fund. It's recommended to have 3 to 6 months of expenses as an emergency fund. This might be too much for you to save in a short period of time. Instead break it down over the course of a few years. This way you can not only save for emergencies, but you can save up for all your other wants and needs. Divide and conquer!

Common Mistakes When Using Sinking Funds and How to Avoid Them

With most things in life, too much of a good thing isn't always good for you. Let's go over a few common mistakes people make when working with sinking funds.

- Over-complicating things: it's easy to get super excited about sinking funds that you create one for every little thing you can think of. The result ends up being a confusing mess of little funds that are difficult to manage. This is one of those times where keeping it simple is the way.

- Neglecting other financial priorities: A sinking fund isn't a replacement for an emergency fund or general savings. I like to think about it as glue to keep your financial plan intact. You should be saving for monthly bills, goals, and to pay off debt. Sinking funds fit in as a strategy to even out those large spikes for non-monthly expenses.

- Using sinking fund money for other purposes: it may be tempting to dip into your sinking funds for money. But remember, it was a plan for you to save up for something specific. Needing to dip into your sinking funds means your plan was not realistic. You may need to reassess your plan.

The Impact of Sinking Funds on Your Financial Future

If it isn't already clear the positive and long-lasting effects of sinking funds can have on your financial future, let's go over them.

Firstly, by using sinking funds you are adopting a mindset shift about money. Most people only consider the typical bills and expenses.

- Groceries

- Eating out

- Vacation

- Electricity

- Rent

- Fun money

The problem is it doesn't take into account real life. Life is unpredictable and for most things you can prepare for them. This changes your mindset from reactionary to being proactive. This is a powerful shift that will change you. Rather than stick your head in the sand, you are choosing to confront those challenges head on.

Additionally, your stress levels will begin to drop and you'll feel more in control of your money. Consider the old you. Trying to budget but feeling like you cannot get ahead. Ever hear "I'm trying to save, but something keeps popping up". With sinking funds things don't generally pop up. Instead you expected them and are prepared for them. Dare I say, you welcomed them.

Final Thoughts

I hope we drove the point home about sinking funds. They're simple yet powerful. A tool that can fit nicely into your general financial plan. I believe everyone needs and can utilize sinking funds. But remember, personal finance is personal. So it's your decision how and where you use them. Start slow to build that muscle. And watch as your financial plans become reality.

CENTSIBLE

CENTSIBLE